Home » CIMA course » What is CIMA?

What is CIMA?Bhumish2023-05-19T09:19:55+00:00

CIMA is the world’s leading professional body of Management Accountants. Management Accountants analyze financial information from a management perspective (as opposed to a compliance perspective e.g. in audit etc) to improve business performance. In that sense, it is a business management function.

What is CIMA?

CIMA (Chartered Institute of Management Accountants) established in the year 1919, is a globally recognized qualification for careers in Business & Finance? CIMA is the world’s largest professional body of Management Accountants with more than 250,000 members working in around 180 countries. CIMA-qualified professionals work in the field of Corporate Finance, Financial Reporting, Financial Analysis, Business Analysis, Project Finance, Treasury Management, Risk Management etc.

In collaboration with the CPA (USA) institute, CIMA members receive an additional designation- CGMA. CIMA has more than 4500 training and recruitment partners across the globe.

Management accountants analyze information to advise strategy and drive sustainable business success. Anyone can study the CIMA qualification, whether they’re new to finance and business or an experienced professional.

Download Brochure

Why CIMA

CGMA

Since the tie up of CIMA & CPA which together give the CGMA Designation, your are sure to catch the eye of the recruiter

Networking

More than 4500 companies are the partner of CIMA around the world and 250000 members in around 180 countries, you get the advantage of exploring job opportunities or business opportunities.

Flexibility

CIMA has the flexibility for the students to study at their own pace and manage their work and study for optimum learning

Cost Effective

Registration, training and examination fee together can costs between Rs. 2 to 4 Lakhs depending upon your prior qualification.

Preferential Immigration Status

Due to the collaboration of CIMA with professional bodies CPA Australia, CIMA members get preferential immigration status abroad.

Talk to a counsellor and know the right path for you

CIMA Career prospects

Course Structure

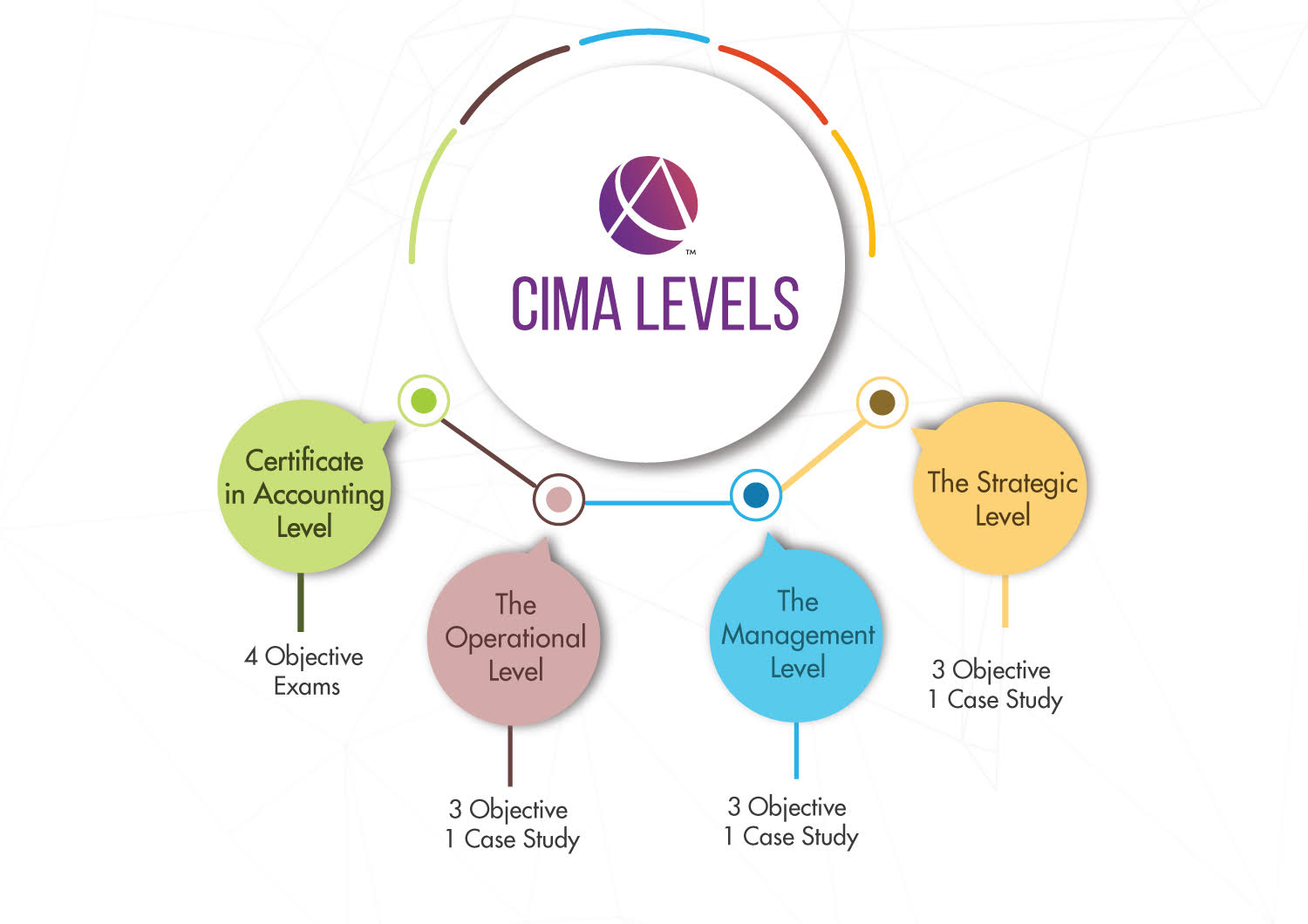

Based on background the student will enter the program from different routes.

Syllabus

Certificate Level

BA1– Fundamentals of Business Economics

BA 2– Fundamentals of Management Accounting

BA 3– Fundamentals of Financial Accounting

BA 4– Fundamentals of Ethics, Corporate Governance and Business Law

Exam: 4 Objective type Exams

Award: CIMA Certificate in business accounting CIMA cert BA

Operational Level

E1:Organizational Management

P1: Management Accounting

F1: Financial Reporting and Taxation

Exam: 3 Objective type Exams and 1 Case study Exam

Award: CIMA Diploma in management Accounting (CIMA dip MA)

Management Level

E2: Project and Relationship Management

P2 : Advanced Management Accounting

F2: Advanced Financial Reporting

Exam: 3 Objective Type Exams and 1 Case study Exam

Award :CIMA Advanced Diploma in Management accounting (CIMA ADV DIP MA)

Strategic Level

E3 Strategic Management

P3 Risk Management

F3 Financial Strategy

Exam: 3 Objective Type Exams and 1 Case study Exam

Exam Detail

Eligibility to learn the CIMA course, duration and entry route

Exam pattern in CIMA across all the levels –

| Objective type | Case study | |

| Exam at each level | 3 | 1 |

| Duration | 90 | 180 min |

| Paper type | Objective type | Integrated case study |

| Exam Frequency | Daily based on availability at Pearson Center | 4 times a year (Feb, May, Aug, Nov) |

| Result Declaration | Immediately | After 1 month of the exam |

Want to know more about CIMA Course by IMS proschool? Click here

FAQ’s

What is the cost of pursuing CIMA Qualification?

There are four categories of fees that a candidate has to pay while pursuing the course.

Registration fees: New students pay a one-time registration fee, which includes their first year’s subscription fee. Note: The CIMA subscription year runs from 1st January until 31st December.

Subscription fees: To study CIMA, you need to pay an annual subscription which is due on 1 January each year.

Exam Fees: The student has to pay exam fees for every examination.

Exemption fees: If a candidate is entitled to any exemptions he/she needs to pay exemption fee per paper being exempted. It is usually equivalent to the exam fees of the corresponding paper

Difference between Case studies exam and Objective type exams?

Objective type Questions:

The Objective Test Questions (OTQs) are used to assess all the certificate level and professional level subjects. You can take the assessment at any time of the year whenever you feel ready. OTQ has different types of questions such as Drag & Drop, Hotspot, Short answer (normal calculation), Drop down, Matching, Ranking, Sentence completion.

Case Study Exam

You need to clear all three objective tests (or receive exemptions for them) from a single level before you can take a case study exam. In the case study exam, you have to apply your knowledge and learning across the three pillars at each level.

The case study exam is set to make the students understand a real business environment. The case relates to a fictionalized organization, however, it is based on real business or industry. Passing the case study exam will showcase your ability to apply the technical, business, people and leadership skills from the three subjects at a particular level in a business context. CIMA assesses various skills in the case study exams which includes research and analysis as well as skills to present and communicate information.

How is the CIMA qualification different from CA?

Most accounting qualifications such as CA, CMA prepare candidates for private practice, financial reporting, audit and tax issues. In contrast, CIMA prepares you for a career in business. CIMA prepares you to work across an organization, not just within finance. In addition to strong accounting fundamentals, CIMA teaches strategic business and management skills. CA takes more than 4 years to complete the qualification and the passing rate is about 5% per level whereas CIMA takes approximately 2-3 years to complete and the passing rate is about 50% to 60%. CA is recognised in India whereas CIMA is recognised in around 180 countries. Moreover, many companies across the world are managed by CIMA members. This is the reason why many companies are looking for CIMA members in India as well.

How is the CIMA qualification different from CWA?

Both CMA and CIMA are Management Accounting qualifications. ICMAI gives more focus on Costing and Finance Accounting, whereas CIMA also focuses on Management Accounting along with strategic business, costing and management Skills. CMA is an Indian Qualification whereas CIMA is an international qualification with more than 250000 members in around 180 countries. Regarding passing rate, CWA stands at 5% whereas the passing rate in CIMA is between 50% and 60%.

How is CIMA qualification different from the ACCA?

CIMA focuses on Business which includes Management, Costing & Financial Accounting whereas the focus of ACCA is more on auditing and accounting work. CIMA and ACCA members are present across the globe.

How is the CIMA qualification different from the CFA?

CIMA focuses more on Management Accounting and also trains you for making strategic business decisions. With skills like these, you can work across verticals in an organization. Whereas, CFA or Chartered Financial Analyst prepares you for a global career in the Investment and Financial Research industry.

Which qualification will offer better job opportunities in India: CFA or CIMA?

Both the qualifications will offer better job opportunities in the Indian job market. CFA was introduced in India before CIMA, Which is why there are many opportunities for them in the job market. But at the same time, more than 20,000 candidates are writing CFA exams in India which is intensifying the competition for them in the job market. While in CIMA, jobs are not restricted to the Financial Services Sector, many European and US-based companies such as Vodafone, KPMG, Ford Motors, Pepsico, Accenture, WNS are hiring CIMA members in India. But due to lower numbers of CIMA members in India, many of these companies are not able to fulfill their requirements.

Why is the passing percentage of CIMA higher than CA or CWA?

Passing percentage of CIMA is between 50% and 60%, whereas for CA and CMA it is 5%. The reason for the higher percentage of passing in CIMA is the exam pattern. In CA/CMA exams, if you are unable to clear a subject in a group then you have to write all the exams of that group. Whereas in CIMA, if you are unable to clear then you have to write and pass only that particular paper. A paper passed is forever passed.

I want to do an MBA in Finance after Graduation? Please let me know how CIMA or PGP Management Accounting can help me?

If you are getting admission in the top 20 B schools in India, then you should go ahead with it. If not, then you can plan for CIMA or PGP Management Accounting because it will offer you more rewarding career opportunities than an MBA in Finance from tier II colleges. For more details you can check below:

Global Recognition: CIMA Professional Qualification is recognized in around 180 countries across the world and nearly 4500+ top recruiters across the world have hired CIMA members in the last year. These give CIMA an edge over most of the MBA programs in India. Moreover, after completing CIMA, members get joint designation CGMA by CPA as well.

Fees: The fees for CIMA qualification (Rs.2 lac to 4 lac) is low compared to the MBA course fee. Moreover, many of the candidates find job opportunities while pursuing CIMA.

Salary: The average salary of the CIMA Professional is very high compared to MBA graduates. Most CIMA professionals get an average salary of Rs.12 lac.

Professional vs Management qualification: The big difference between CIMA and an MBA is that a CIMA qualified member is entitled to call himself/herself a qualified management accountant. This is not the case with an MBA since it is a management qualification.

Knowledge and skills: CIMA qualified members across the world are at par in terms of knowledge acquired. However, many different institutions offer MBA and hence the knowledge and skills levels are highly variable.

Job opportunities: With more than 2 lac MBA grads coming in every year, MBA graduates have no edge over other candidates. CIMA being a new emerging qualification in India that offers multi-dimensional skills, gets various job opportunities in India for students and members. Moreover, MNCs prefer CIMA or CPA.

Is ACCA harder than CIMA?

They are equally the same in the amount of effort required. The decision on which to study ought to be based on what you want to focus on; CIMA is more business focused and ACCA is more accountancy-focused. Of course, your work experience after passing ultimately counts for more than your choice of qualification.

If you have a related degree, then you may get different exemptions.

How many papers are there in CIMA?

There are a total of 12 papers in 4 levels and 3 case studies.

Join our elite club of 50,000 students upskilling in IMS Proschool Right Now

Inquire Now

Our Blog

Get an insight into the creativity of our team.

Explore our Videos

Join our elite club of 50,000 students upskilling in IMS Proschool Right Now

Inquire Now

IMS Proschool – Shaping Careers, Building Lives Upskilling Professionals and Enhancing Competencies

IMS Proschool is the market leader in delivering exceptional career-building courses using intensive professional certifications.

Book A Free Demo

Mumbai

9867958900

Thane

9867842800

Sion

9619207323

Navi Mumbai

9867842800

Pune

8454988892

Delhi – Connaught Place

7304957442

Delhi – Pitampura

9136687002

Gurgaon

7738674974

Noida

9136687679

Lucknow

7389180009

Kolkata

8591956474

Hyderabad

9136908879

Bangalore

7892295842

Kochi

9645629999

Chennai

9600137479

Online

9867994700

Contact us

7710044425

info@proschoolonline.com

Monday – Sunday:

10:00 AM – 07:00 PM