An important measure of profitability for a business

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What is Operating Margin (Return on Sales)?

Operating margin, also known as return on sales, is an important profitability ratio measuring revenue after the deduction of operating expenses. It is calculated by dividingoperating incomeby revenue. The operating margin indicates how much of the generated sales is left when all operating expenses are paid off.

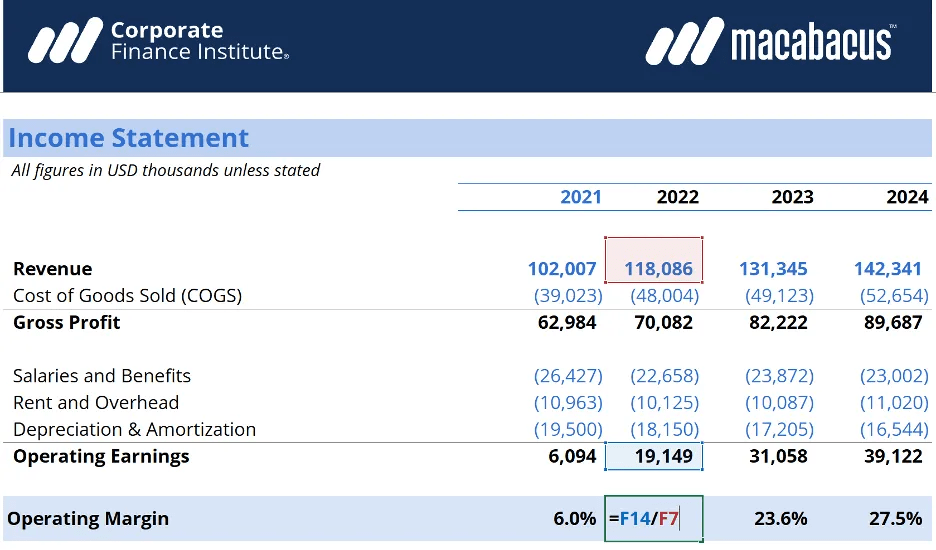

In the above example, you can clearly see how to arrive at the 2022 operating margin for this company. 2022 has revenue of $118.1 million, less COGS of $48.0 million, resulting in gross profit of $70.1 million.

From there, another $22.7 million of salaries and benefits, $10.1 million of rent and overhead and $18.2 million of depreciation and amortization expenses are deducted, to arrive at operating income of $19.1 million.

By taking $19.1 million and dividing it by $118.1 million in revenue, we arrive at an operating margin of 16.2%, which is why operating margin is sometimes referred to as return on sales.

Key Highlights

- Operating margin, also known as return on sales, is an important profitability ratio measuring revenue after covering the operating expenses of a business.

- Operating margin is calculated by dividing operating income by revenue.

- A business that can generate operating profit rather than a loss is a positive sign for potential investors and existing creditors. This means the company’s operating margin creates value for shareholders and continuous loan servicing for lenders.

Operating Margin Formula

Operating Margin = Operating Income / Revenue

Another example: DT Clinton Manufacturing company reported on $125 million in revenue in its 2022 annual income statement. Operating income before tax was $45 million after deducting $80 million in operating expenses for the year. As a result, the company has an operating margin of 36%. In other words, for every dollar in sales achieved, $0.36 cents is retained as operating profit.

Free Operating Margin Template

Why is Profit Margin Important in Business?

A business that can generate operating profit rather than operating at a loss is a positive sign for potential investors and existing creditors. This means that the company’s operating margin creates value for shareholders and continuous loan servicing for lenders. The higher the margin a company has, all things being equal, the less financial risk it has. However, different industries will have different operating margins so any comparisons made should be relative to other, similar companies in the same industry.

Continued increases inprofit marginover time shows that profitability is improving. This may either be attributed to efficient control of operating costs or other factors that influence revenue, such as higher pricing, better marketing and increases in customer demand.

Operating Margin/Profit Drawbacks

Operating profit is an accounting metric, and therefore not an indicator ofeconomic valueorcash flow.Profit includes several non-cash expenses such as depreciation and amortization, stock-based compensation, and other items.Conversely, it doesn’t include capital expenditures and changes in working capital.

In conjunction, these various items that are included or excluded can cause cash flow (the ultimate driver of value for a business) to be very different (higher or lower) than operating profit.

To learn more, read all aboutbusiness valuation.

Additional Resources

Net Income

Operating Income

Depreciation Schedule

Revenue Enhancement

See all accounting resources

FAQs

A higher operating margin indicates that the company is earning enough money from business operations to pay for all of the associated costs involved in maintaining that business. For most businesses, an operating margin higher than 15% is considered good.

What is the answer to the operating profit margin? ›

Operating Profit Margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes and interest charges. It is calculated by dividing the operating profit by total revenue and expressing it as a percentage.

How do you calculate the operating margin? ›

Operating margin, also known as return on sales, is an important profitability ratio measuring revenue after the deduction of operating expenses. It is calculated by dividing operating income by revenue. The operating margin indicates how much of the generated sales is left when all operating expenses are paid off.

What is a good operating expense margin? ›

What Is a Good Operating Expense Ratio? Good operating expense ratios range between 60% and 80%. The lower the operating expense ratio, the better an investment it is.

How to interpret operating profit margin? ›

Interpreting Operating Profit Margin

In this case, operating profit margin is the amount of revenue that remains after accounting for the direct production and selling costs. When operating margin is high, it means that the amount of operating profit generated on each dollar of revenue is high.

What is considered a good margin? ›

An NYU report on U.S. margins revealed the average net profit margin is 7.71% across different industries. But that doesn't mean your ideal profit margin will align with this number. As a rule of thumb, 5% is a low margin, 10% is a healthy margin, and 20% is a high margin.

How to improve operating margin? ›

The operating margin can improve through better management controls, more efficient use of resources, improved pricing, and more effective marketing. In its essence, the operating margin is how much profit a company makes from its core business in relation to its total revenues.

Can operating margin be negative? ›

Operating margins can be negative because if a company spends too much money manufacturing a product or its overhead costs are too high, then it could accrue a negative operating profit.

Is operating margin and profit the same? ›

Operating profit margin, also called operating margin, is the ratio of a company's operating profit to its sales or revenue. Operating margin is just one of several ways to measure profit margin. It is usually expressed as a percentage; the higher the percentage, the more profitable the company is.

What is for profit operating margin? ›

The operating profit margin is calculated by subtracting the cost of goods sold and selling, general and administrative expenses (also called operating expenses or SG&A) from net sales. That number is divided by net sales, then multiplied by 100%.

Example of Operating Profit

10,00,000 from the sales of computer hardware. The company incurred operating expenses of Rs. 6,00,000, which include the cost of goods sold, salaries, rent, utilities, and other expenses related to production, administration, and selling activities.

Is operating margin the same as Ebitda? ›

Operational margin emphasises day-to-day efficiency, while EBITDA offers insights into a company's overall earnings potential, making both metrics valuable tools for investors seeking a nuanced understanding of a company's financial health.

What is the best operating profit margin ratio? ›

Generally, a 10% operating profit margin is considered an average performance, and a 20% margin is excellent. It's also important to pay attention to the level of interest payments from a company's debt.

What is considered a good operating ratio? ›

Expressed as a percentage, the operating expense ratio is your total operating expense (excluding interest), minus depreciation, divided by gross income. The normal operating expense ratio range is typically between 60% to 80%, and the lower it is, the better.

Can operating margin be over 100%? ›

Margins can never be more than 100 percent, but markups can be 200 percent, 500 percent, or 10,000 percent, depending on the price and the total cost of the offer. The higher your price and the lower your cost, the higher your markup.

Is 30 operating profit margin good? ›

What is a good operating profit margin? If the company tends to earn more money from the respective business, which can pay all their business costs by compensating with the profit, then the company tends to have a good OPM. Businesses holding 15% higher operating margins are supposed to be good.

Is 30% a good profit margin? ›

In most industries, 30% is a very high net profit margin. Companies with a profit margin of 20% generally show strong financial health. If this metric drops to around 5% or lower, most businesses will need to make changes to remain sustainable.

Is 40% a good margin? ›

The 40% rule is a widely used benchmark for assessing a startup's financial health and the balance between growth and profitability. This rule of thumb emphasizes that a company's growth rate and profit, typically represented by the operating profit margin, should collectively reach 40%.

Is 75% profit margin good? ›

What is a good gross profit margin ratio? On the face of it, a gross profit margin ratio of 50 to 70% would be considered healthy, and it would be for many types of businesses, like retailers, restaurants, manufacturers and other producers of goods.